April 7, Public Safety Sales Tax Question

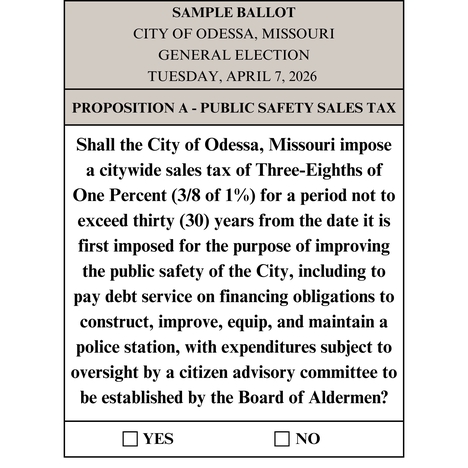

On April 7, 2026, voters of the City of Odessa, Missouri, will be asked to consider establishing a three-eighth-cent public safety sales tax that would provide funding for a new police facility.

| Public Safety Sales Tax Fast Facts

|

How Will This Affect Odessa's Sales Tax Rate?If the three-eighth-cent sales tax is approved, the City's sales tax rate of 8.975% would increase to 9.35%. | Public Safety Sales Tax Ballot Language

|

Financial Plan Summary

If approved, the revenue from the 3/8-cent Public Safety Sales Tax would be used to pay the financing obligations to construct, improve, equip, and maintain a police station with those expenditures subject to oversight by a citizen advisory committee. It is designed to fund a maximum $4.9 million project which includes both hard costs (actual construction) and soft costs (architectural fees, surveying, testing, site development, security equipment, furnishings, and technology). We encourage you to read the consolidated summary of the financial plan for the use of the tax for more information.

Frequently Asked Questions

If approved by voters, when will the public safety sales tax go into effect?

October of 2026

If approved, how could the City use the Public Safety Sales Tax?

The revenue would be used to pay the financing obligations to construct, improve, equip, and maintain a police station with those expenditures subject to oversight by a citizen advisory committee.

How much extra revenue will this half-cent public safety sales tax generate?

The revenue could exceed $255,000 annually.

Who will pay this sales tax?

Everyone that shops in the City of Odessa, both residents and non-residents. This tax does not affect gasoline or city utilities. Local commercial and industrial businesses pay sales tax unless exempt.

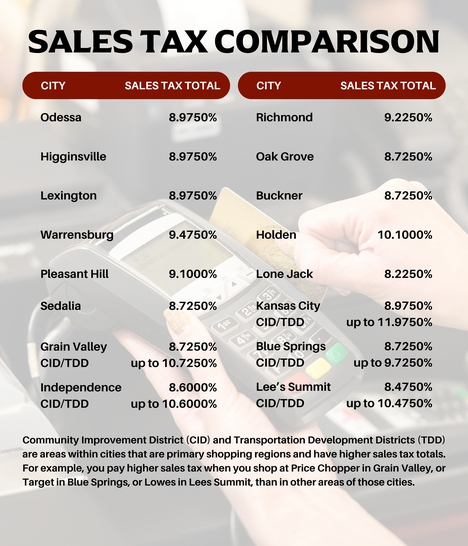

How will this affect the City’s sales tax rate and how does it compare to neighboring cities?

If approved, the City’s sales tax rate of 8.975% would increase to 9.35% in October of 2026. In comparison, Lexington and Higginsville are both at 8.975%, Oak Grove is at 8.725%, and Warrensburg is 9.475%. Additional city comparisons can be found in the chart above.

How much more will this half-cent sales tax cost an Odessa shopper?

How would a public safety sales tax affect current funding for public safety?

The tax will only be used to pay the financing to construct, improve, equip, and maintain a police station, will not replace the city’s public safety budget, and cannot be commingled with non-public safety City funds.

When do I vote on this proposition?

April 7, 2026